B2B Product Management: Inertia and Alternatives

This is part 1 of many: Sharing some learnings to make building B2B products less scary.

You've researched the market and your users and built a fantastic product; somehow, you struggle to find your first users. Even offering free trials, freemium access, and giving away free perks are not garnering your user’s interest. Sounds familiar? if yes, your product is being pushed apart by one of two major forces: Inertia and Alternatives.

Building for other Businesses

The B2B space is very complex by definition as many types of businesses, industries, and company sizes exist. Still, for the sake of this article, I’ll put particular emphasis on the company size.

There are three main categories for companies in the B2B space based on this article from Close.com a sales CRM for small businesses and startups:

Small and Medium Businesses (SMBs): They can be your local restaurant, mom and pops, your friend’s e-commerce store, or any business with less than 100 employees (definition may vary per country). They account for the vast majority of businesses and in my opinion, are the closest you get to building B2C products as you need to rely on automated sign-up and onboarding flows to acquire and activate customers to keep your operations cost-efficient and scalable.

Mid-Market: between 100 and 1,000 employees, as the name suggests are right in the middle. This means the company is more stable than an SMB and they have more spending ability, but in exchange, their needs are a bit more complex and might need an extra layer of customization. This company size is where you start receiving laundry lists from the Sales teams with features required to close the next big deal or retain a customer, let me know in this poll if you’d like me to cover how to manage these ‘lists’

Enterprise: According to the article I referenced, here we are talking about really big companies usually multinationals, Fortune 500 (or your country's equivalent), or even Governments. Customization here is the rule more than the exception, contract values are measured in millions of dollars per year and usually, you end up building your product for the biggest customers or a handful of them.

Now that we’ve spent some time talking about types of B2B companies, we can describe how they are related to the two forces I mentioned lines above: Intertia and Alternatives.

Moving up the market: Inertia

Let’s start with this definition:

Inertia

a tendency to do nothing or to remain unchanged.

As we move up the market, companies get bigger and more complex as a result they have more inertia. Making any significant changes, even if they reap an economic benefit, is a really difficult quest (yes, I used quest intentionally) as bureaucracy, processes, and internal politics disincentivize change.

As a product manager, it’s especially difficult to build for this type of company as you need to identify the different types of personas that are present in a company. I found an excellent article by ‘Product Plan’ that gives a detailed explanation of this topic but based on my experience I want to propose a slightly different approach for this segmentation focusing on higher up in the market as the lines start to blur when you move back to SMBs:

End-User: Will be the person using your product in their day to day, this is the person that you’d like to ask for usability feedback but not necessarily about your product’s value for the business as in some cases they are forced to use your product especially when the main benefit is around efficiencies or time reduction in processes.

Economic Buyer: The decision maker with the budget to invest in your product. They’ll not use the product on a daily basis so the decision to keep your product will be based entirely on the ROI. A good practice is to create a use-case where they can easily access and view the benefit of the product, e.g Sending an automated report every Monday at 8 am outlining how much money/time the company saved by using your product.

Champion: I’ve heard this persona more in marketing than product environments, and I’d say is right in the middle between the user and the economic buyer. They are advocates of your product and if they don’t have the budget they’ll fight for it inside the organization. This is the person that will help you break the inertia, and they will be both interested in business value, operational feasibility, and benefits of your product. This profile is a little bit trickier than the other two as they can also be End-Users or Economic Buyers, and to identify them you need to build a close relationship with your Sales and Customer Success counterparts so they can name a few people with such attributes.

Moving down the market: Alternatives

Before jumping ships and going straight to building for SMBs let me break the bad news to you, there’s also a component that adds complexity, and it’s called alternatives.

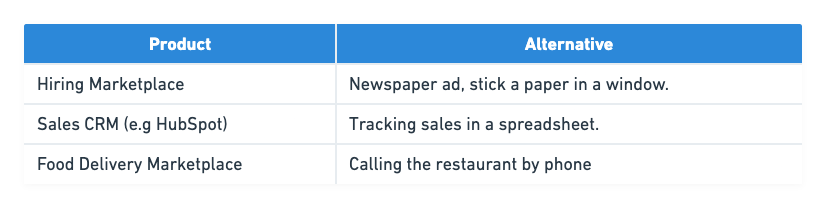

One mistake we usually make as Product Managers is to limit our market research to mapping out competitors, our product is meant to solve a real problem for customers and a competitor’s product is just a different solution to the same problem made by a team that is interpreting the same market signals and user insights in a different way or executing a different strategy (assuming both are targeting the same market segment) the recommendation here is to broaden the scope of your market research and include other tools or artifacts that your users are relying on to solve their problem. To make this concept more tangible I’ll provide some examples:

If there are cheap or free alternatives, then why build products for SMBs? The answer lies in scale, in the case of many SMBs the owner is portraying the three personas we identified earlier so they are in the weeds solving problems and operating the business, and their main interest is to free up some time to keep growing the business or just enjoy some more time with family and friends.

An exercise that I found useful when building this type of product is asking myself: “When will <insert alternative> break?”

Suppose a core process or activity breaks at a certain point. In that case, it means it will be a blocker for growth so by asking that question you should be in a good position to identify the key outcomes (or features) the customer needs to unlock growth and also your main selling lines when trying to market the product. Another important aspect of asking this question is the ability to get an additional data point to identify who your Ideal Customer Profile (ICP) is; as an example, if the Sales CRM alternative breaks at ~150 deals per month then you can target companies with a certain sales size or use that data point for self-identification in the pricing page of your product.

Takeaways

Building B2B products can be intimidating, but product managers can make it less daunting with the right approach. I’ll summarize what I consider are the main ideas you should take with you to build an amazing B2B product:

Identify who your champion is, they will help you break the first force of inertia that is mostly present in Mid-Market to Enterprise companies.

Create a use-case for the economic buyer, they think about ROI and get usability feedback from the End-User

Strengthen your competitive analysis including alternatives and ask yourself when will this alternative break for the user.

Asking that question can also inform the process of building your Ideal Customer Profile (ICP) and also be used as cues to help the user find out if the product is the right alternative for them or the pricing plan they might want to purchase.

I’d love to have your thoughts in the comments section, and I’m also open to any questions or requests on topics to cover. Visit my personal web page to find the best way to reach out.